RF VALUE strategy

Stock selection using economics value model

Buy and hold with quarterly observing & rebalance

RF Value: Strong Points

- Low trading expenses: Our theory focus on adjusted economic data, based on quarterly financial results, so turnover will be low.

- Good dividend yield: Although we do not focus on selecting dividend stock, our by product from good selection will result in good dividend yield stocks.

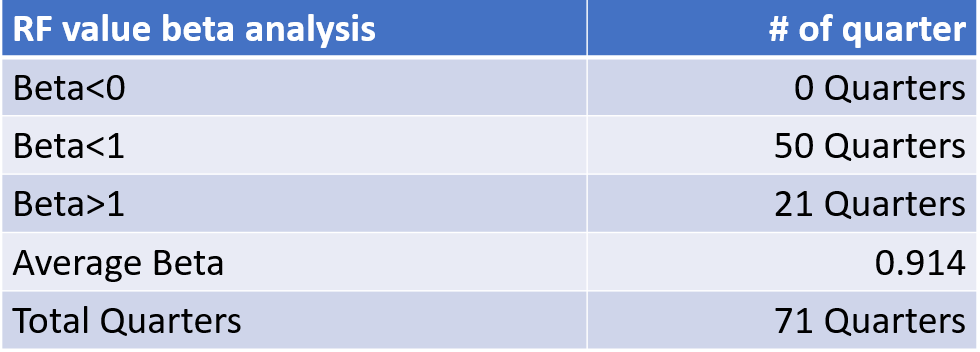

- Low Beta: another by product is the lower beta portfolio.

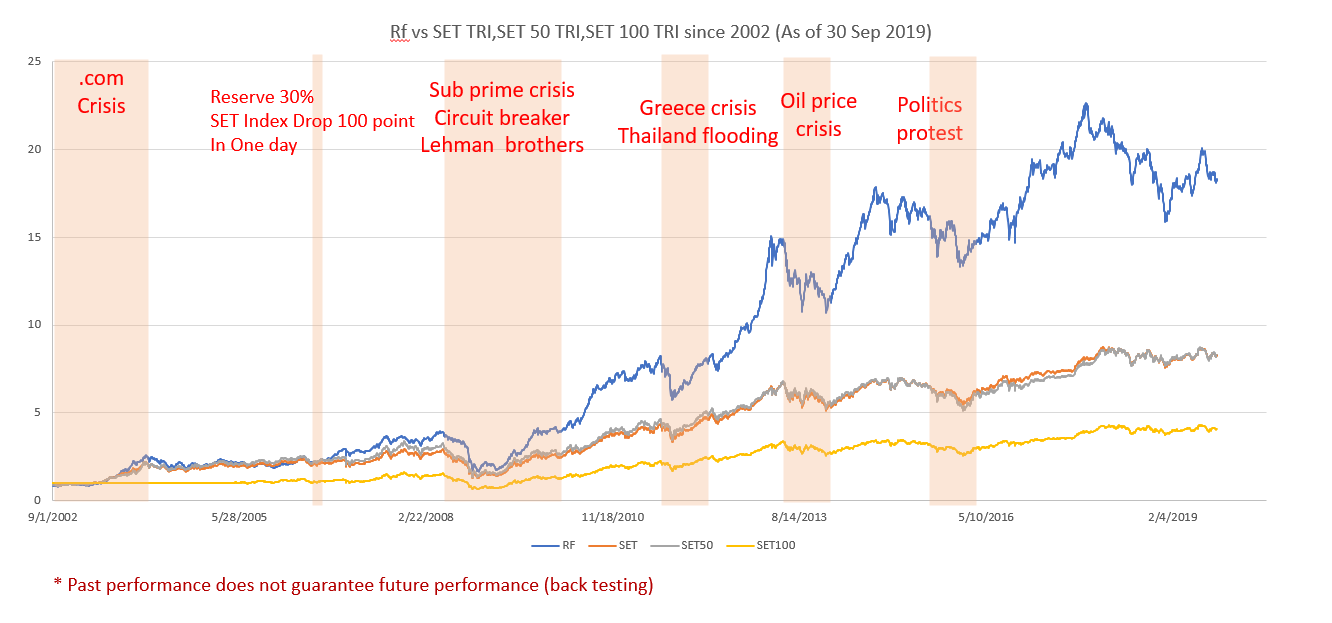

Back testing Conditions

- 17 years of adjusted financial data

- About 178 stocks, with average daily trading value 30 D >10 MTHB

- Top 30 Stocks for each quarter

- Observe and rebalance the holding quarterly

- Selection excludes bank and financial sectors

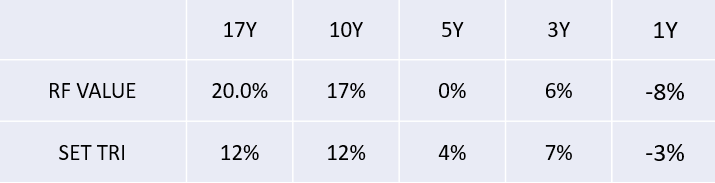

BackTesting Result

Quantitative result

* Past performance doest not guarantee future performance (back testing)

%

Annual standard deviation

%

Annual Sharpe Ratio

%

Maximum drawdown

RF Value and Dividend

- In comparison to SETHD (SET high dividend index), RF value and SETHD have 5 stock in common, HANA, TTW, ORI, BLAND, AP

- As of November 5, 2019, RF value portfolio has a 5.9 % dividend yield (exclude special dividend from NOBLE), compared to 5.05 % from SETHD

RF value and BETA

Disclaimer

Important information

Important: The above information is not for general circulation and should not be considered an offer, or solicitation, to deal in any of the mentioned funds. The information is provided on a general basis for information purposes only, and is not to be relied on as advice, as it does not take into account the investment objectives, financial situation or particular needs of any specific investor. Any research or analysis used to derive, or in relation to, the information herein has been procured by Renaissance Fund Management Ltd. for its own use, and may have been acted on for its own purpose. The information herein, including any opinions or forecasts have been obtained from or is based on sources believed by Renaissance Fund Management Ltd. to be reliable, but does not warrant the accuracy, adequacy or completeness of the same, and expressly disclaims liability for any errors or omissions. As such, any person acting upon or in reliance of these materials does so entirely at his or her own risk. Any projections or other forward-looking statements regarding future events or performance of countries, markets or companies are not necessarily indicative of, and may differ from, actual events or results. No warranty whatsoever is given and no liability whatsoever is accepted by Renaissance Fund Management Ltd. or its affiliates, for any loss, arising directly or indirectly, as a result of any action or omission made in reliance of any information, opinion or projection made in this information. The information herein shall not be disclosed, used or disseminated, in whole or part, and shall not be reproduced, copied or made available to others. Renaissance Fund Management Ltd. reserves the right to make changes and corrections to the information, including any opinions or forecasts expressed herein at any time, without notice.